'Compromise for the sake of peace'

By Bob Quinn

MONROE — The deal to create the new Town of Palm Tree hinges on an agreement between the Kiryas Joel and Monroe-Woodbury school districts to redraw their boundaries.

Both the Village of Kiryas Joel and United Monroe issued press releases this week, hailing what Gedalye Szegedin, Village Administrator for Kiryas Joel, said was a “historic agreement (that) creates a framework to allow each community to thrive by enabling Monroe and Kiryas Joel to chart their own destinies and determine their own communal needs and priorities. This agreement should serve as a model for mutual respect and acceptance of our cultural differences.”

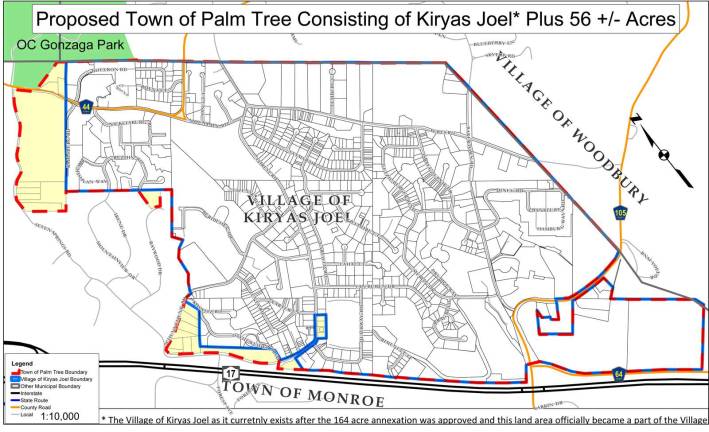

The proposed new town would include all of the Village of Kiryas Joel, the 164 acres that were annexed last year, plus an additional 56 acres in the unincorporated portion of the Town of Monroe, all north of Route 17.

An underlying cause for all this has been the extraordinary growth of Kiryas Joel’s population, which is estimated at 25,000. And that’s expected to double in a generation. Thousands of housing units already are being built within the village even as many hundreds of families have found homes outside KJ in Monroe, Woodbury and Blooming Grove.

The agreement, should it pass muster with at least 14 of the 21 Orange County legislators, would then lead to a town-wide referendum in November, asking all residents living in the town as well as the villages of Harriman, Kiryas Joel and Monroe to decide the fate of their communities.

‘Comprehensive’In its press release, United Monroe described the agreement as “comprehensive.”

“This agreement sets in motion a plan to settle Preserve Hudson Valley’s lawsuit over the 164 acre annexation and to put an end, once and for all, to Kiryas Joel’s on-going attempt to annex 507 acres of land from the Town of Monroe,” said Michael Egan, who led the negotiations for United Monroe and Preserve Hudson Valley; Emily Convers, chairwoman of United Monroe; and John Allegro, director of Preserve Hudson Valley, in a joint statement.

“The plan also supports politically separating the two municipalities,” the statement continued. “This would give the citizens of both municipalities the ability to separately pursue their destinies and quality of life aspirations which sharply differ. Kiryas Joel has focused on urban-style living and the rest of the town is centered on suburban and semi-rural living. Our hope is to end Monroe’s many years of strife caused by the battle for control of the Town Board with its far-reaching powers over annexation, zoning, board appointments, permits, tax monies and employee hiring.”

School boundariesMeanwhile, each side was adamant about the redrawing of the boundaries of the Monroe-Woodbury School District and the Kiryas Joel School District to reflect the borders of the new towns.

“In the forefront of all discussions,” Szegedin said, “is the goal to protect all the kids from the MWSD and the KJSD and the integrity of each communities’ institutions.”

In their statement, Egan, Convers and Allegro said: “We are extremely pleased to report that the plan also guarantees the integrity of the Monroe-Woodbury Central School District. It predicates the creation of the new town on the alteration of school district boundaries so that the new town and the Kiryas Joel Union Free School District are coterminous.”

In its press release, United Monroe also said the agreement required that the boundaries of the school districts be altered so that the Kiryas Joel School District “conforms to the new town’s boundaries before the Legislature votes on the new town. Without such change, the agreement will terminate.”

Almost from the first that Kiryas Joel sought the annexation of land from the unincorporated portion of the Town of Monroe, people have expressed concerns about what would happen if an ever-increasing Hasidic population would gain control over the Monroe-Woodbury School Board. These concerns centered on what had happened to the East Ramapo School District, where the Hasidic community took over the school board and then began disassembling programs to the point where students could not graduate. A state monitor now oversees the district.

Residents in the Town of Monroe had already seen the power of the KJ bloc vote in local elections. Could — or would — the same happen in school board elections?

The Village of Kiryas Joel and the Kiryas Joel School Board have long stated they were prepared to adjust the boundaries between the two school districts.

Monroe-Woodbury school officials have been studying the issue for several years, weighing transportation costs, property tax revenue and special education costs.

“Now that an agreement has been signed and the metes and bounds determined, the Monroe-Woodbury School District’s Boundary Alteration Committee will perform its final due diligence so the committee, hand in hand with the district administration, can present a recommendation about boundary alteration to the Board of Education,” said School Board President Jon Huberth. “We realize time is of the essence, and as always our highest priority is providing our community’s students the best education now and on into the future.”

‘For the sake of peace’The Orange County Legislature is scheduled to hold public hearings on the proposed new town on Aug. 15 and 16.

Following those public hearings, a vote of the Orange County Legislature would occur in September, requiring a two-thirds majority to pass.

If approved by the Legislature, the next step would be a town-wide referendum for the voters in Monroe on Nov. 7.

According to the Orange County Board of Elections, there are 22,823 voters in Monroe, 10,083 reside in KJ and 12,750 reside in Monroe outside of Kiryas Joel.

“The petition to split off the KJ community from Monroe is being pursued by all sides with one-and-only goal in mind: ‘to create a solid foundation for a lasting peace between the residents of KJ and the residents of Monroe’ by giving both communities independence from the other without any political interference,” Szegedin said. “The KJ leadership is willing to go out of its comfort zone to usher in an era of peace and harmony in the Monroe/KJ areas. We appreciate the effort, time and energy invested in this process by all involved officials and groups. We recognize that negotiations are always a give and take and sometimes it’s more give than take, but we must compromise for the sake of peace.”